5 Easy Facts About Best Broker For Forex Trading Shown

Table of ContentsUnknown Facts About Best Broker For Forex TradingBest Broker For Forex Trading Things To Know Before You BuyThe smart Trick of Best Broker For Forex Trading That Nobody is DiscussingAbout Best Broker For Forex TradingMore About Best Broker For Forex Trading

Because Foreign exchange markets have such a huge spread and are utilized by a substantial variety of participants, they offer high liquidity in comparison with various other markets. The Foreign exchange trading market is constantly operating, and thanks to modern technology, comes from anywhere. Hence, liquidity refers to the truth that anyone can get or offer with an easy click of a switch.Consequently, there is constantly a potential retailer waiting to acquire or sell making Forex a liquid market. Cost volatility is just one of one of the most important factors that aid pick the next trading move. For temporary Foreign exchange investors, cost volatility is important, considering that it depicts the hourly changes in a possession's value.

For long-lasting financiers when they trade Forex, the cost volatility of the market is also basic. One more substantial advantage of Forex is hedging that can be applied to your trading account.

How Best Broker For Forex Trading can Save You Time, Stress, and Money.

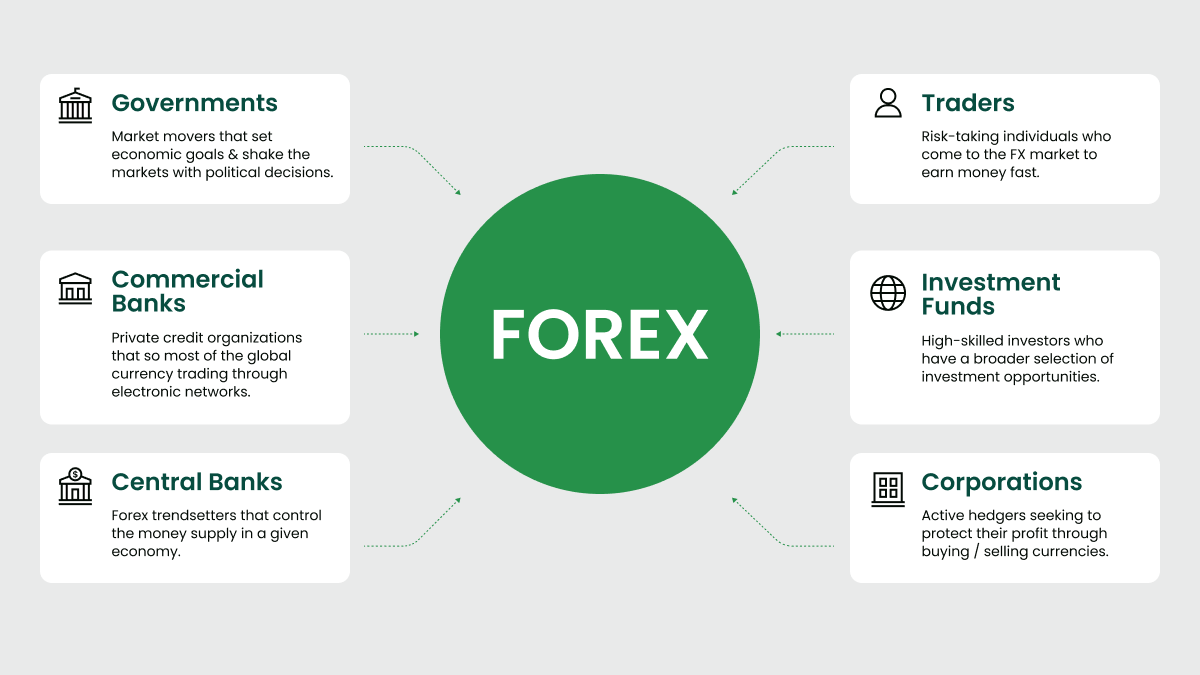

Relying on the moment and initiative, traders can be separated into classifications according to their trading design. Some of them are the following: Forex trading can be effectively applied in any one of the approaches above. Due to the Foreign exchange market's great quantity and its high liquidity, it's feasible to enter or exit the market any type of time.

Foreign exchange trading is a decentralized modern technology that functions with no central management. That's why it is a lot more at risk to fraudulence and other sorts of perilous tasks such as deceptive pledges, extreme high threat degrees, and so on. Therefore, Foreign exchange guideline was created to develop a straightforward and read this moral trading perspective. A foreign Forex broker must comply with the standards that are specified by the Forex regulatory authority.

Thus, all the purchases can be made from anywhere, and considering that it is open 24 hr a day, it can additionally be done any time of the day. For instance, if an investor is situated in Europe, he can trade during North America hours and check the moves of the one money he wants (Best Broker For Forex Trading).

Getting The Best Broker For Forex Trading To Work

Most Foreign exchange brokers can provide a very low spread and decrease or even eliminate the trader's costs. Financiers that select the Forex market can increase their revenue by staying clear of costs from exchanges, deposits, and various other trading tasks which have added retail transaction costs in the stock market.

It provides the option to enter the market with a small spending plan and trade with high-value money. Some traders may not satisfy the needs of high utilize at the end of the purchase.

Forex trading might have trading terms to secure the market participants, yet there is the threat that somebody might not appreciate the agreed agreement. The Foreign exchange market functions 24 hours without quiting.

When retail investors refer to rate volatility in Forex, they suggest exactly how huge the upswings and drop-offs of a currency pair are for a details period. The larger those ups and downs are, the higher the cost volatility - Best Broker For Forex Trading. Those useful reference large modifications can evoke a sense of uncertainty, and in some cases investors consider them as a chance for high revenues.

The Ultimate Guide To Best Broker For Forex Trading

A few of the most unstable money pairs are taken into consideration to be the following: The Forex market uses a great deal of advantages to any kind of Forex trader. As soon as having decided to trade on forex, both seasoned and newbies require to specify their financial strategy and obtain acquainted with the terms.

The material of this write-up mirrors the writer's viewpoint and does not always show the official placement of LiteFinance broker. The material published on this page is attended to informational purposes just and need to not be thought about as the provision of financial investment suggestions for the purposes of Regulation 2014/65/EU. According to copyright law, this article is considered intellectual home, that includes a restriction on duplicating and dispersing it without permission.

If your firm operates globally, it is necessary to recognize exactly how the worth of the united state dollar, relative to various other currencies, can substantially influence the price of products for united state importers and merchants.

Excitement About Best Broker For Forex Trading

In the early 19th century, money exchange was a significant component of the procedures of Alex. Brown & Sons, the first financial investment bank in the USA. The Bretton Woods Arrangement in 1944 required currencies to be fixed to the United States dollar, which was in turn secured to the price of gold.